The online stamp duty payment procedure is quick easy and transparent. Department of Registration Stamps IGR e-Search Free View Valuation Report for assessment of Stamp Duty eASR.

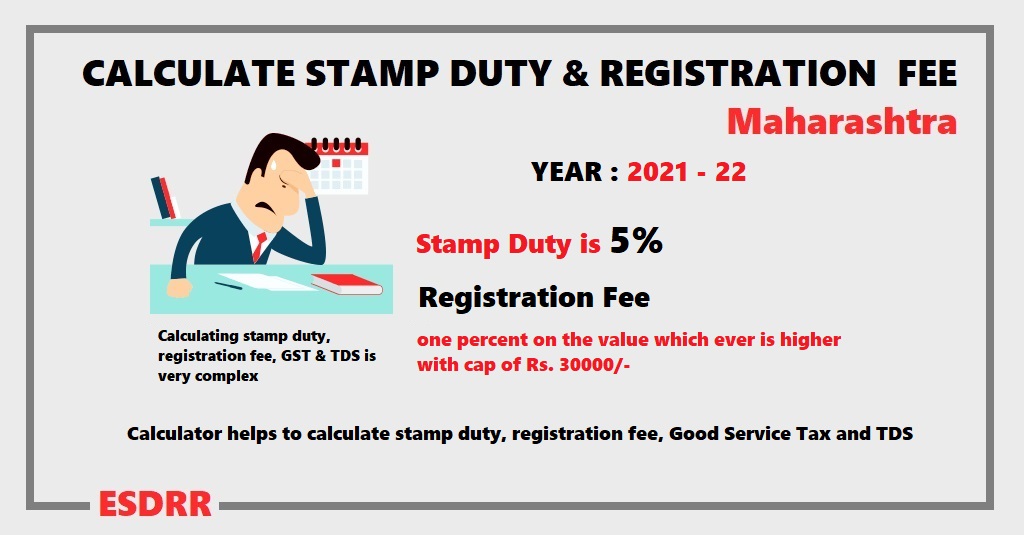

Stamp Duty And Registration Fee Calculator Mahrashtra

Of Registration StampsMaharashtra All queriesComments regarding the contents may be sent at IGR PuneMS DISCLAIMER.

E stamp registration maharashtra. Applicable Stamp Duty. To apply for a refund the application has to be submitted to the stamp collector from where the stamps have been purchased along with the necessary documents within the. Please note that this page also provides links to the websites webpages of Government Ministries Departments Organisations.

Of Registration StampsMaharashtra All queriesComments regarding the contents may be sent at IGR PuneMS DISCLAIMER. After payment Receipt of online payment to get e-SBTR to be presented at the selected branch for obtaining e-SBTR. The acceptance of on-line payment of Maharashtra States Taxes through the internet portals of various banks have been developed.

All above activities can be. 6 Get it registered. 34 CHECKLIST FOR REGULAR REGISTRATION.

Department of Registration Stamps Maharashtra 2015 RFAP for e-Registration of Leave License document through Authorized Service Providers Page 9 of 43 3 Project Background 31 About Department of Registration and Stamps The Department of Registration and Stamps has a vast expanse in the state of Maharashtra and looks after registration and preservation of documents and recovery. E-SBTR print is free of cost. Maharashtra State Excise department enables citizens to benefit from a single window access to services related to various Licenses such as Temporary function Licenses to do trade sale and other manufacturing of Liquorits raw materials track the Application.

2 Stamp Duty and Registration fee should be paid online through GRAS httpsgrasmahakoshgovin Calculate Stam D And Re stration Fees Information owned maintained and updated by. To simplify the process of registration of ownership a number of state governments have introduced an e-payment of stamp duty. The first step is logging on to the Maharashtra stamp and registration department website.

Maharashtra State Excise Login Fully Online. 4 Execute sign it. 5 Submit it for registration.

29 th February 2020 Offices work from Monday to Friday. Best viewed in IE10 Firefox Chrome Safari Opera. Food Public Distribution System PDS Demand for new ration card.

E-Registration made available to Citizen by Stamps and Registration Department of Maharashtra State. Know the valuation Calculate the Stamp Duty Registration fee to be paid. Of Reg stration StampsMaharashtra All queriesComments regarding the contents mav be sent at IGR puneMS.

EC fees document preparation charges are other. Above list of Registrars offices in Maharashtra etc. Pay stamp duty for delivery of goods in the form.

Such factors include determinants such as total cost incurred for the transaction whether the location of the property comes within urban or rural areas etc. Calculate Stamp Duty And Registration Fees Next This Module is developed and made available by Stamps and Registration Department of provides facility of online registration of Leave and Licenses Agreement to Citizen. E-stamp registration facility would help home buyers to pay the stamp duty registration fee or any other charges online with a few clicks.

Banks for On line ePayment for eChallan. Stamp Duty and Registration Charges in Maharashtra. Department of Registration Stamps Government of Maharashtra.

This transactional tax applies to both residential and commercial. Please note that this page also provides links to the websites webpages of Government Ministries Departments Organisations. Inspector General of Registration and Controller of Stamps.

The Maharashtra Stamp Act 1958 allows refund of stamps purchased by citizens if the purpose of its use is cancelled or if the stamp is damaged before its use or if it is overpaid. Pay search fee in the form of e-Challan. Please note that this page also provides links to the websites webpages of Government Ministries Departments Organisations.

The e-stamp registration service would allow home buyers to pay stamp duty registration fees and other fees online with a few clicks. With this citizen can 1 Prepare their Agreement. Pay judicial stamp fee in the form of e-Challan.

Sub Agent Banks for ePayments. The stamp duty in Maharashtra varies within the State If the property falls within the boundaries of the municipal corporation. In Mumbai stamp duty is levied under the Maharashtra Stamp Duty Act.

Banks for Counter Payment for eChallanSimple Receipt. Online service to pay stamp duty registration fees. Pay stamp duty and registration fees in the form of e-Challan.

The Stamp Duty is established on the agreement value or the market value and may vary from property to property and place to place. 3 Modify if necessary. To pay stamp duty home buyers will need to follow a few simple steps.

Book your convenient Date and time to register deed. Citizens who want to register their document in these offices from 2392021 are requested to use PDE20 and. Using this module citizen can 1 Prepare their Agreement 2 View the draft 3 Modify if necessary 4 Execute sign it.

From 2392021 onwards the newly developed iSarita 20 shall be used for document registration in SRO Haveli 21 and 23 Pune. Enter Data of Your transaction to avoid errors and to speed up registration. If you are not registered.

Multiple payments for. Applicable Stamp Duty Rates Applicable Stamp Duty Rates from 1-Sep-20 to 31-Dec-20. Homeowners pay it at the time of property registration.

E-Registration under the Maharashtra Value Added Tax Act 2002 MVAT Act Central Sales Tax Act 1956 CST Act and Maharashtra State Tax on Professions Trade Callings and Employments Act 1975 PT Act. The content of these websites are owned by the respective organisations and they may be contacted for any further information or suggestion. Home Agencies Agencies.

Stamp duty rates in Maharashtra state is determined by various factors. Of Registration StampsMaharashtra All queriesComments regarding the contents may be sent at IGR PuneMS DISCLAIMER. Please ensure the following for faster registration at the Sub Registars office.

Maharashtra Stamp Duty and Registration Charges. Simple Receipt is valid for Compulsorily Registrable Documents only and e-SBTR is valid for both Optional Compulsorily Registrable Documents.

The Department of Registration and Stamp is liable for property registration in the state of Maharashtra. E-stamp registration facility will help buyers pay stamp duty registration fee or any other charges online with a few taps. The content of these websites are owned by the respective organisations and they may be contacted for any further information or suggestion.

The online stamp duty payment procedure is time-efficient. To simplify the process of property registration several State governments have launched e-payment of stamp duty. It provides facility of online Registration of Leave and Licenses Agreement to Citizen.

Stamp duty is a transactional tax collected by the government and fixed by the Central authorities. Registration fees and stamp duty are not the same in all states of India so itll vary from state to state. The content of these websites are owned by the respective organisations and they may be contacted for any further information or suggestion.

For Online payment your Net banking transaction amount limit will be effective. 2 View the draft. Are for general information only.

The stamp duty amount depends on the propertys market value or agreement value during the time of registration. We have provided the Help Line Number of Registration and Stamp Department Maharashtra Pune if. 32 PUBLIC DATA ENTRY.

Stamp Duty And Registration Charges In Mumbai Maharashtra

Stamp Duty In Maharashtra Stamp Duty And Registration Charges In Maharashtra

Stamp Duty In Maharashtra Stamp Duty And Registration Charges In Maharashtra